Program Manager & Continuous Improvement Lead

Business, Sales, Customer Care, RPA, CI

Tableau, RPA, GenAI Transcription, CRM, SMS Gateway

Shift from reactive cancellation processing to proactive revenue rescue

In the payments industry, merchant churn is the silent killer. Acquiring a new merchant is significantly more expensive than retaining an existing one. With a massive merchant base, Geidea needed a systematic approach to identify "at-risk" merchants before they left permanently.

The goal was to shift from reactive "cancellation processing" to proactive "revenue rescue"—intercepting churn before it becomes permanent.

The organization faced high-volume churn without clear segmentation strategy or intervention framework.

Ambiguity existed between a merchant who was "seasonally dormant" versus one who had "switched to a competitor"—both treated identically despite requiring different interventions.

We needed to systematically target a cohort of 30,000+ at-risk merchants—impossible to address through manual outreach alone.

No standardized feedback loop existed to understand why merchants were leaving. Churn data was lost, never feeding back into product or service improvements.

"The opportunity: design a comprehensive Churn Management Program that segments merchants by inactivity, performance drops, and sentiment—deploying targeted retention strategies at scale."

I moved the organization away from a static "days inactive" model to a dynamic two-front defense strategy combining interception and prediction.

Re-engineered the offboarding workflow to create a "Cancellation Trap." Instead of processing cancellations immediately, requests are re-routed to a specialized Retention Team. Goal: force human negotiation using "Save Offers" (rental waivers, rate adjustments) before any terminal is collected.

Triangulated three distinct signals to predict churn probability:

Inactivity detection—merchants who simply stopped transacting. Early warning before complete disengagement.

TPV Drop monitoring—active merchants showing rapid decline (>15-50% MOM), indicating business split to competitor.

VOC integration—merchants who gave "Detractor" scores (0-6) on surveys, flagging immediate emotional risk.

I designed a tiered intervention logic based on signal severity and merchant value to ensure efficient resource allocation at scale.

Churn recovery process: end-to-end intervention workflow

Automated actions based on specific thresholds:

| Risk Level | Inactivity Trigger | Performance Trigger (MOM TPV Drop) | Action Taken |

|---|---|---|---|

| Early Warning | 0 – 5 Days | > 15% Drop | Automated SMS (Health Check) |

| Risk | 14 – 30 Days | > 30% Drop | Telesales Call (Retention Agent) |

| Critical | 30 – 60 Days | > 50% Drop | Field Visit (Sales Representative) |

High-Value Merchants bypass automated flows entirely. Any Performance Drop or Negative VOC Score triggers immediate alert to their dedicated Relationship Manager for same-day personal visit.

"We turned churn intervention from a cost center into an intelligence engine—every saved merchant teaches us how to prevent the next one."

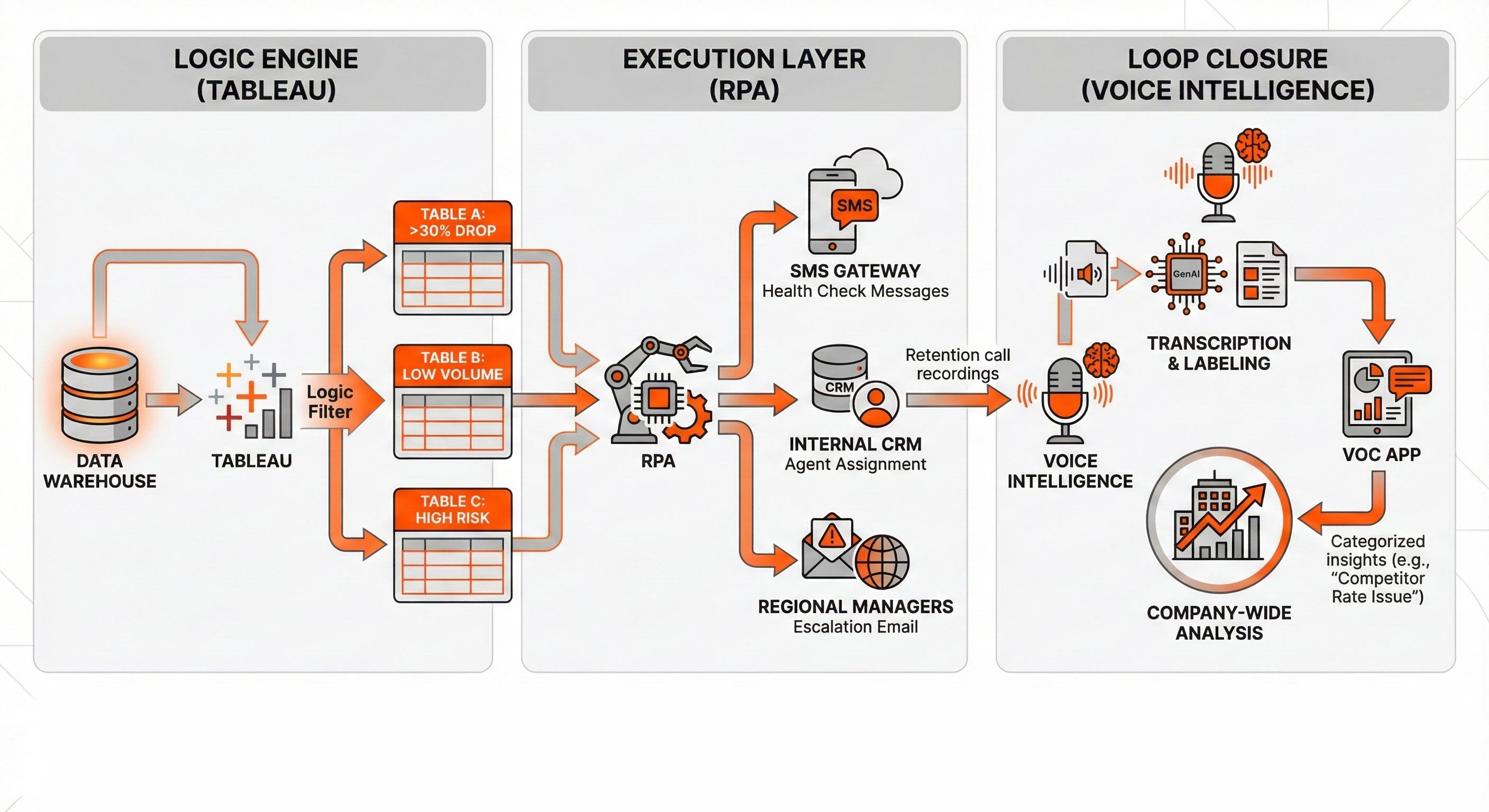

To ensure this ran at scale without daily manual intervention, I architected a low-code automation pipeline combining analytics with robotic execution.

Built dynamic daily dashboards connected to Data Warehouse. These act as the "Logic Filter," streaming merchant data into distinct tables based on trigger criteria (e.g., "Table A: >30% Drop").

Technical architecture: Tableau logic engine → RPA execution → GenAI voice intelligence

By shifting from reactive cancellation processing to a predictive, automated retention engine, we achieved transformational results between January and December.

"We transformed churn from a revenue leak into an intelligence engine—every retention conversation now feeds organizational improvement."